Navigate the politics of planning

Political and stakeholder engagement. Risk management for consultation.

We have a 360 degree perspective having sat in every seat around the committee table, from Councillor to Officer, Project Team to Representer.

Would you like to find out more about...

Continue scrolling

Politics with a small-p

In a period of council restructuring, financial pressure and growing political disengagement, consultation on planning applications and policy development requires more than traditional expertise.

COALFACE brings together committee room decision-making experience, political intelligence, and data-driven analysis to strengthen proposals in today's challenging environment.

Our approach recognises that planning decisions are made by people, influenced by political dynamics, local pressures, and governance realities. We provide the insight needed to navigate this complex landscape.

Click to change

Click to change

Click to change

Click to change

Our Services

Comprehensive planning support grounded in political reality and delivered with intelligence

Engagement

Intelligence-driven community consultation shaped by political behaviour and committee room realities.

Learn More

Insight

Planning analysis that explains decision-making processes and provides actionable intelligence.

Learn More

Council Scanner

Diagnostic tool for assessing council planning behaviour and identifying key decision-makers.

Learn MoreLatest Insights

Research, analysis, and commentary on UK planning and local government

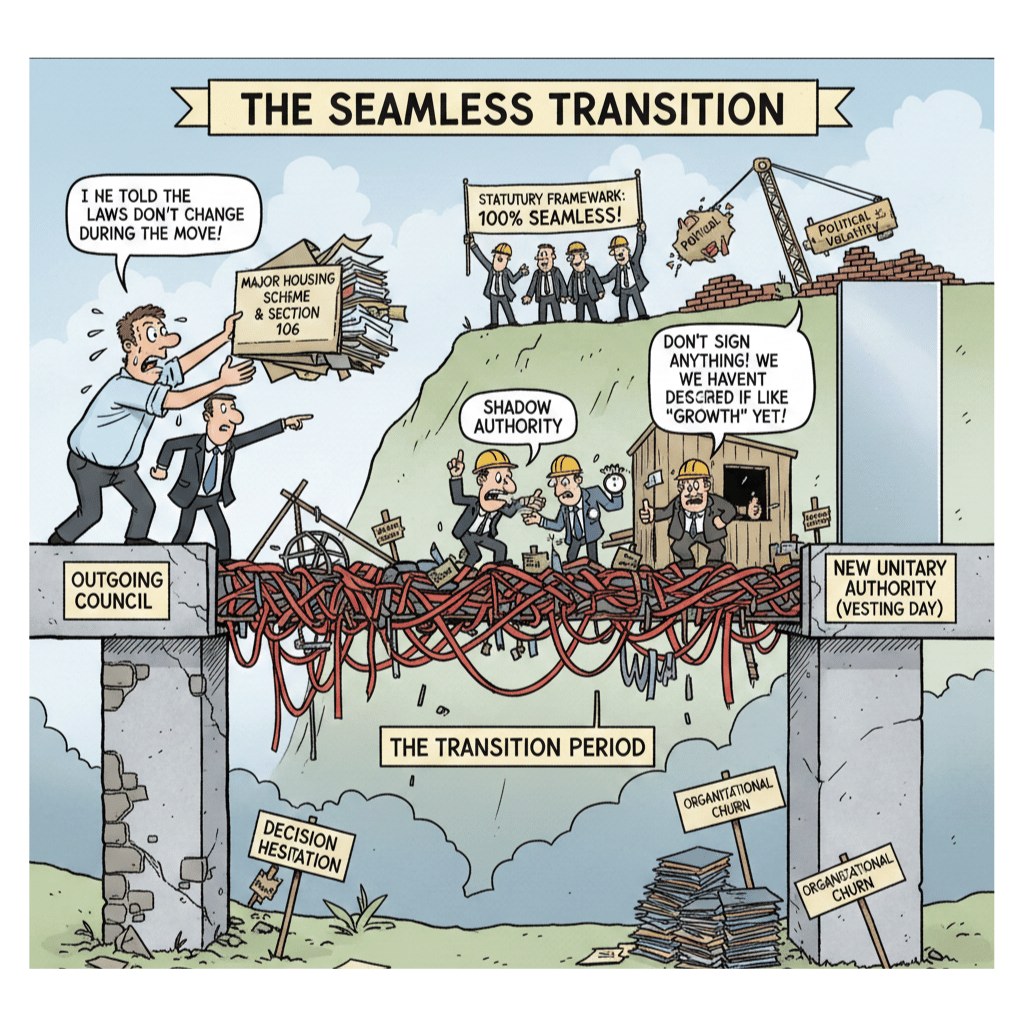

Planning Through Reorganisation: What Local Government Reform Really Means for Decision Making

Local Government Reorganisation creates a prolonged period of political, organisational and operational uncertainty that directly affects how planning decisions are made, timed and defended.

WHY COALFACE™

We bring together planning expertise, political fluency and modern engagement capability to support decisions that stand up to scrutiny.

PLANNING EXPERTISE

From planning applications to Local Plan preparation, we deliver planning consultation that recognises policy constraints, political conditions and statutory expectations.

POLITICAL FLUENCY

We interpret the political and organisational pressures shaping planning decisions, including LGR transitions, section 114 exposure and committee dynamics.

DIGITAL CAPABILITY

Modern, proportionate digital tools enable efficient community engagement and insight gathering without compromising depth or representativeness.

WHAT OUR CLIENTS SAY

TESTIMONIALS

Our partners value the clarity, political understanding and practical judgment we bring to complex schemes and programmes.

Knowledge of the planning process adds real depth to the communications produced, and a background in both politics and planning enables an informed and sensitive approach to planning-related communications and engagement.

CHIEF PLANNING OFFICER

Local Government

An excellent operator and has been a valued collaborator on several projects. Brings strong expertise in politics, stakeholder engagement and communications. We would recommend working with without hesitation.

DIRECTOR

Community Engagement Consultancy, Private Sector

Subscribe to Our Newsletter

Stay informed with the latest insights on UK planning and local government

Frequently Asked Questions

Common Questions

Quick answers to your most frequently asked questions

Ready to Strengthen Your Planning Application?

Get in touch to discuss how we can support your project